Personal Lines of Credit

Get a line of credit so you can draw on cash when you need it. Apply Now! The Application is free and lenders are online 24/7 ready to accept your application.

How Do You Get a Personal Line of Credit?

Click Apply Button

First click the Apply Now button and then enter your basic information and click the submit button.

Get An Instant Decision

Once you submit your application you will recieve an instant decision in under 90 seconds.

Approved Get Cash

Get approved and agree to the rate and terms and then you will receive your funds as soon as the next business day.

What is a Personal Line of Credit?

A personal line of credit is a type of financing that allows you to withdraw funds as needed, up to a maximum limit.

This can typically range from $1,000 to $35K. There is no credit score needed and no collateral required when you apply through TaxAdvancesNow.com.

How does a personal line of credit work?

While personal loans offer potential borrowers a lump sum of cash upfront with a fixed interest rate and with monthly payments, personal lines of credit work more like a credit card.

When you’re offered a personal line of credit, you’re provided a maximum limit to how much you can borrow and you can withdraw as much or as little as you need.

Interest is only charged on the amount you borrow, and rates are typically variable.

Because a personal line of credit is an open-end credit you can draw on it several times up to your maximum credit limit.

How can you use a personal line of credit?

Similar to personal loans, personal lines of credit can be used in ao many ways.

Personal lines of credit can be used to pay off credit cards, consolidate debt, make a large purchase, or go on vacation.

A personal line of credit may be especially useful if you’re anticipating a large expense such as a home remdel or business.

How To Apply Online

To get your line of credit online loan, all you have to do is fill out the online request form.

Once you submit your online personal line of credit loan application, you will get an instant decision in under 90 seconds.

Get approved and your line of credit will be ready to use as soon as the next business day.

Frequently Asked Questions

Find quick answers to common questions using our helpful FAQs.

Should You get a Personal line of Credit?

The best financing option will depend on your oen financial situation. Everyone’s needs are different. While a personal line of credit isn’t a good option for everyday purchases iy can help make large purchases or consolidate bills.

Does a personal line of credit affect your credit score?

When you apply at banks and credit unions they do credit checks. With our lenders they do not do hard credit checks and by applying online for a personal line of credit does not affect your credit score.

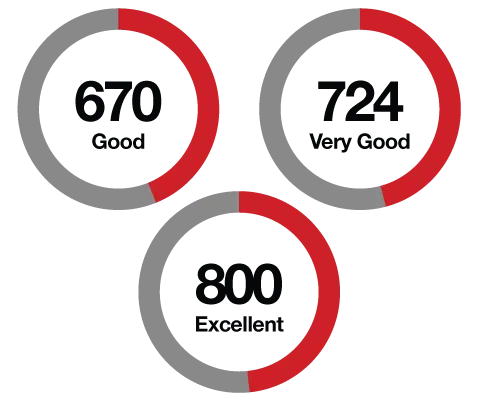

What credit score do you need to get a personal line of credit?

If you apply online you do not need a credit score to apply.

What are the advantages of a personal line of credit?

Some afavntages to a personal line of credit are:

- Free Application

- No Hard Credit Check

- Instant Online Decision

- Money Direct Deposit

People Love Fast Loans

See Why People Choose Us As Their Go To Source for a Line of Credit

Speedy Service

Excellent SPEEDY professional service… such a blessing! It really filled my need for fast cash. ⭐️⭐️⭐️⭐️⭐️

Kelly S.

Customer

Professional

Got approved within minutes and I had my cash in my bank the next day. I would give it 19 stars if I could. Great service!⭐️⭐️⭐️⭐️⭐️

Don R.

Customer

High Level Service

i had a cash crunch situation. Car was broke down and I needed cash to fix it and pay for a rental. The lenders came through for me. Thanks again! ⭐️⭐️⭐️⭐️⭐️

Kathleen H.

Customer

APR Disclosure

Some states have laws limiting the Annual Percentage Rate (APR) that a lender can charge you. APRs for cash advance loans range from 200% and 1386%, APRs for installment loans range from 6.63% to 225%, and APRs for personal loans range from 4.99% to 450% and vary by lender. Loans from a state that has no limiting laws or loans from a bank not governed by state laws may have an even higher APR. The APR is the rate at which your loan accrues interest and is based upon the amount, cost and term of your loan, repayment amounts and timing of payments. Lenders are legally required to show you the APR and other terms of your loan before you execute a loan agreement. APR rates are subject to change. If you have questions about your loan contact your lender directly and for any other questions contact us thriugh customer service.

Material Disclosure

Exclusions

Residents of some states may not be eligible for some or all short-term, small-dollar loans.

Credit Implications

Tax Advances Now does not make any credit decisions. Independent, participating lenders that you might be connected with may perform credit checks with credit reporting bureaus or obtain consumer reports, typically through alternative providers to determine credit worthiness, credit standing and/or credit capacity. By submitting your information, you agree to allow participating lenders to verify your information and check your credit. Consider seeking professional advice regarding your financial needs, risks and alternatives to short-term loans. How do I reach customer service? You can email us at info@taxadvancesnow.com